The financial future of any medical practice is directly tied to the accuracy of its data and the stability of its finances. However, for private equity (PE) groups, the reporting requirements become much more complex. By having accurate and reliable data from financial reporting dashboards for medical practices, investors can gain valuable insights into the financial health of an organization.

Medical Practice Payment Trends

With advances in electronic health record (EHR) and billing technology, medical practice payment and collections have undergone significant changes. Coupled with the rise in consumerism, patients are demanding more convenient and transparent billing for healthcare services. In addition, insurance companies are increasingly shifting the cost burden to patients through high deductibles and copays.

Naturally, these factors lead medical practices to re-evaluate their payment processes and collections strategies, with many turning to automated billing and online payment platforms to streamline operations and increase efficiency. As the healthcare economics continue to shift, practice managers must stay ahead of the curve to ensure financial transparency and appeal for PE firms.

Ensuring Compliance and Avoiding Penalties

One of the most significant challenges that medical providers face is ensuring compliance with financial regulations and maximizing the prevention of financial repercussions. Accurate medical financial reporting ensures sufficient monitoring that helps practices stay compliant with laws, regulations, and ethical standards. The terms of private equity contracts also may require due diligence in compliance in these areas to avoid any potential penalties. Timely and accurate reporting assists with compliance and reduces risks for negative consequences, such as lawsuits and reputation damage.

Financial Reporting Dashboards and KPIs for Private Equity Investors

Medical financial reports generate a clear outlook of a practice’s financial performance, providing investors with the transparency and clarity they need to make informed decisions. In turn, robust reporting gives investors confidence in a practice’s ability to deliver stable returns.

Financial dashboards and key performance indicators (KPIs) are important starting points in the due diligence process regarding the growth, efficiency, and profitability of a practice. Essential medical practice KPIs include the following areas.

Revenue Cycle Management Metrics

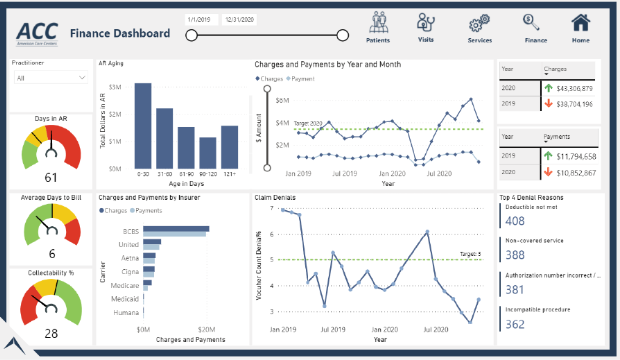

Revenue cycle management (RCM) is the process of managing a practice’s revenue streams, from the initial patient encounter to final payment. RCM KPIs include average days in accounts receivable (AR), percentage of claims submitted and accepted in the first submission, and denial rate. These metrics can help identify risks by indicating any bottlenecks in the billing and payment process, cash flow, or revenue.

Operating Costs Metrics

Operating costs include all expenses incurred to run a practice, including salaries, rent, supplies, insurance, and other overhead costs. Operating cost KPIs also include expenses per provider, expenses per patient, and operating margins. These metrics can help investors assess the overall profitability of a practice and help providers identify areas where they can reduce costs.

Patient Metrics

Patient metrics show how well a practice is performing in terms of patient acquisition, retention, and satisfaction. Patient KPIs include new patient acquisition rate, patient retention rate, and patient satisfaction score. These metrics can help investors identify both patient demographics and retention.

Provider Productivity Metrics

Provider productivity metrics measure how effectively providers are using their time to care for patients and include patient visits per provider, provider time utilization rate, and provider revenue per patient.

Cash Flow Metrics

Cash flow is the lifeblood of any business, including medical practices. Cash flow KPIs include cash reserves, cash flow ratios, and cash conversion cycle. These metrics can help monitor a practice’s liquidity and identify potential cash flow problems.

Leveraging Year-to-Date Financial Reporting for Greater Investor Insights

Year-to-date financial reports include a summary of revenues, expenses, profits, and losses and operational metrics like patient volumes and billing information. Said financial reports can be generated on a monthly, quarterly, or annual basis to provide a snapshot of the financial health of a practice.

Additionally, these reports can help practice managers make informed decisions about the practice’s future, such as whether to expand services or invest in new technology. Year-to-date financial reports for medical practices also provide valuable insights for investors into the following areas.

Financial Performance

Regular financial reporting tracks revenue and expenses, providing valuable insights into the financial health of the practice. By reviewing financial statements such as balance sheets, cash flow statements, and income statements, investors can see how a practice is faring in terms of profitability potential. This information can also help inform strategic decisions to increase revenue and reduce costs.

Potential Errors

Routine financial reporting can help identify potential errors in a practice’s financial records. By having a clear understanding of financial performance, any unusual or suspicious activity can be detected and investigated. Strong financial controls and regular reporting also can help prevent fraud and ensure the accuracy of financial records.

Financial Accountability

Financial reporting provides transparency and accountability to a practice’s stakeholders, including investors, creditors, and regulatory agencies. By providing accurate and timely financial reports, practices can build trust and credibility with these stakeholders. It also can help secure financing, attract new patients, and maintain compliance with industry regulations.

Aging Reports

Aging reports track outstanding invoices from the patient and their insurance company and provide a summary of the amount owed and the length of time the debt has been outstanding. Understanding and addressing the reasons for aging receivables is essential to maintaining financial stability.

Most aging reports feature a table that includes patient accounts, the name of the debtor, the date of service, and the balance of the bill. The report may also list each patient’s overall balance to provide medical practices better control of their collections. By using aging reports, medical practices can identify the most pressing billing issues and collect compensation from past due debts.

Summary: Financial Reports for Medical Practices

Medical practice financial reporting is critical for private equity groups. It provides vital information for due diligence efforts regarding making informed decisions and maintaining compliance. Medical practices and investors must have financial reporting that is current, accurate, and fosters transparency to ensure success.

Medical Practice Financial Reporting for Private Equity

From acquisition to exit strategy, we deliver management and technology expertise, tools, best practices, and proven methodologies to boost performance. By leveraging financial dashboards, data reporting, and more, our experienced consultants increase practice and portfolio values to maximize ROI. Contact us to learn more.