Revenue cycle management (RCM) is a crucial aspect of healthcare that oversees the proper management of patient billing and insurance claims. How its various stages are managed — from the registration of a patient to the collection of payments for the services rendered, etc. — determine an organization’s financial health. In this guide, you will learn about the impacts and components of a model RCM.

What is Revenue Cycle Management in Healthcare and Why is it Important?

Healthcare management revenue management cycle is a critical component of operations, with significant implications for the financial performance and patient experience of healthcare organizations. Effective revenue management cycle practices can maintain patient satisfaction, attain operational efficiency, increase financial performance, align with Value Based Care (VBC) incentives, and assure compliance and risk management.

Improved Patient Experience

By putting patients at the center of RCM processes, healthcare providers can improve patient loyalty and retention, leading to increased revenue and profitability. RCM best practices can improve the patient experience in several ways. Firstly, accurate and timely billing for patient services can reduce the confusion and frustration that affect a patient’s confidence in a practice. Additionally, automated appointment reminders and online payment options can improve patient convenience and satisfaction.

Enhanced Operational Efficiency

RCM practices can also streamline healthcare operations, reducing the administrative staff burden. This can include optimizing electronic health records (EHRs) and automated billing processes to reduce errors and increase efficiency. Additionally, integrating RCM with other operational systems, such as clinical data management, can improve coordination and communication across healthcare teams. By reducing unnecessary administrative costs and improving efficiency, healthcare providers ultimately free up resources that can be redirected to delivering high-quality care.

Increased Financial Performance

Effective RCM practices are essential for ensuring financial stability and profitability for healthcare organizations. When an organization is looking to increase revenue, a comprehensive assessment of the RCM is necessary. For example, by reducing billing errors and improving the efficiency of billing and collections, healthcare providers can increase their revenue and reduce costs associated with denied or delayed payments. Additionally, RCM can help healthcare providers identify opportunities for cost savings and revenue growth, such as negotiating better payment rates with insurers or identifying high-value services to focus on.

Alignment with Value-Based Care Incentives

VBC underscores the importance of delivering high-quality, cost-effective care. This means that healthcare providers must be able to measure and demonstrate the value of their services, with financial incentives tied to patient outcomes. Effective RCM practices can facilitate the measurement and reporting of quality metrics and identify opportunities for improving patient outcomes and reducing costs. By aligning RCM practices with VBC incentives, healthcare providers can validate the value of their services and better succeed financially in an increasingly competitive healthcare landscape.

Improved Compliance and Risk Management

Finally, effective RCM practices are essential for ensuring compliance with regulatory requirements while also minimizing financial risk. This includes ensuring compliance with healthcare privacy and security regulations and accurate and timely reporting for government programs such as Medicare and Medicaid. By proactively managing compliance and risk, healthcare providers can protect revenue from financial penalties and reputational damage, ensuring the long-term financial viability of their organizations.

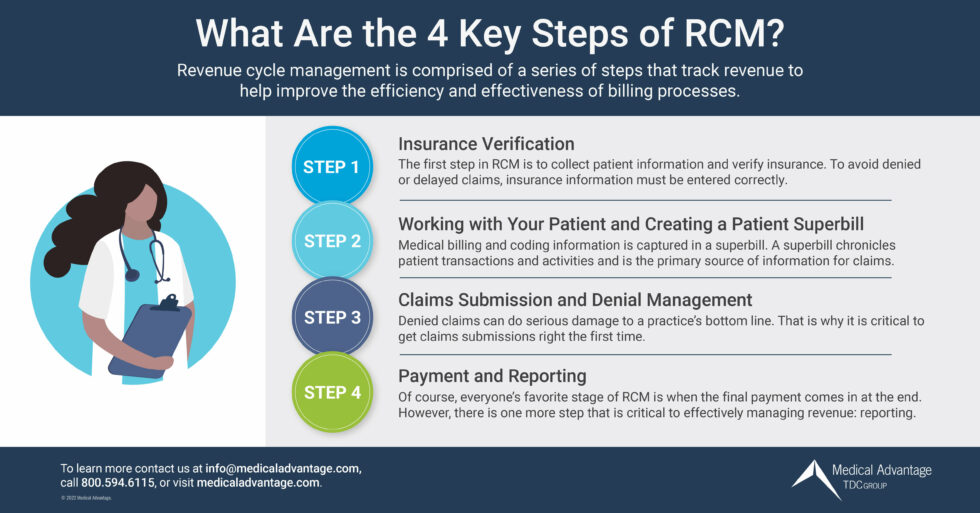

Understanding the RCM Process

Optimizing RCM for your organization addresses each aspect of its ecosystem. Medical practices can increase financial performance by making improvements to all stages of the RCM from ensuring patients are properly registered to securing reimbursement and payment for services rendered.

1.) Pre-registration and Registration

The first stage of revenue cycle management in healthcare involves pre-registration and registration. The pre-registration stage comprises collecting patient information before arriving at a healthcare facility to make the intake process more convenient. Providers may outsource the intake process to third-party vendors to improve efficiency and accuracy.

Complete and accurate registration captures patients’ demographics, insurance information, billing information, and consent to treatment. This step is crucial for ensuring billing and documentation accuracy and avoiding denied insurance claims. The sooner a patient’s registration is completed, the sooner a provider can verify insurance.

2.) Verification of Insurance

The second stage of the revenue cycle management process involves verifying patient insurance eligibility. This step confirms patient insurance coverage and the benefits included in their coverage policy. This proactive measure affirms the services requested by the patient’s healthcare provider will be honored by the payer, avoiding rejected claims and unanticipated expenses for patients.

3.) Clinical Documentation

Clinical documentation is crucial to revenue cycle management since it involves the proper documentation of patient care. Healthcare providers must accurately document their care for the services rendered to patients. Clear and concise documentation is vital to ensuring efficient claims processing and settling service charges. This documentation reflects the diagnosis, treatment, medications, and all other services provided during patient care.

4.) Claim Submission and Follow-up

The fourth stage of revenue cycle management involves charge capturing and submitting claims to the insurance companies that provide the necessary coverage for the patient. To receive full reimbursement, providers should ensure that claims are correctly submitted, and that they meet the insurer’s criteria for timely and accurate processing. When necessary, follow-up on claims must be done frequently to provide room for submission of appeals.

5.) Final Payment Collection

The final phase of the revenue cycle management process is payment collection. This stage involves the collection of payments for services rendered. Providers must ensure all claims are paid in full, monitor and investigate underpayments, and institute methods of collecting unpaid balances. Healthcare providers must comply with all legal processes that apply to payment collections.

Revenue Cycle Management Systems

With increasing financial pressures and tight margins, healthcare providers need to rely on reliable and robust revenue cycle management systems to sustain financial health. The following are some of the most popular vendors providing valuable revenue cycle management systems.

eClinicalWorks

eClinicalWorks offers a cloud-based revenue cycle management system that streamlines billing processes and improves revenue collections. Their system provides real-time claims scrubbing, which checks for errors before claims are submitted, reducing the risk of denials and allowing for faster reimbursements. eClinicalWorks also provides a patient portal that enables patients to pay their bills online, improving collections and reducing costs from administrative overhead.

NextGen™ Healthcare

NextGen offers a comprehensive revenue cycle management system designed to optimize your revenue cycle and enhance your operational efficiency. Their system is user-friendly, intuitive, and customizable to meet your unique needs. It offers advanced analytics that enable you to monitor your financial performance, improve your billing processes, and make informed decisions that can enhance revenue.

Allscripts

Allscripts is another leading vendor for revenue cycle management systems in healthcare organizations. Their solution is designed to automate administrative tasks such as eligibility verification, claim submission, and claims denial management, reducing the time spent on manual data entry while also minimizing the risk of errors. Allscripts also offers integrated patient statements, which can be printed or emailed to patients, improving communication to reduce billing-related inquiries.

Epic Systems

Epic Systems offers a comprehensive healthcare revenue cycle management system. Their system streamlines billing processes, improves revenue collections, and integrates seamlessly with electronic medical records, eliminating the need for manual data entry. Epic also provides advanced reporting capabilities that enable healthcare providers to monitor their finances in real-time, identify issues, and make timely decisions for best management of revenue.

Cerner

Cerner provides a wide range of revenue cycle management solutions designed to help healthcare organizations improve their financial performance. Their system integrates with patient registration and scheduling systems, helping providers to accurately capture patient data and submit clean claims. Cerner also offers automated denial management, which identifies, and resolves denied claims more efficiently, reducing the time spent on administrative appeals.

What are Revenue Cycle Management Best Practices?

Healthcare organizations need to develop and implement best practices for RCM to optimize their revenue streams and improve the patient experience. The following best practices for RCM promote the best financial outlook of organizations and enable providers to provide better care to their patients.

Develop a Comprehensive RCM Plan

The first step in optimizing RCM is to develop a comprehensive RCM plan. This plan should define the processes and workflows for all RCM activities, along with the roles and responsibilities of all stakeholders. Comprehensive RCM plans should also consider the changing healthcare landscape, insurance payer requirements, and reimbursement policies.

Invest in Technology

Technology plays a significant role in RCM, and healthcare organizations need to invest in the best fit in technology to optimize their RCM processes. There are several software solutions available that support RCM activities. These include EHR systems, revenue cycle management software, and patient management systems.

Enhance Staff Training

One of the most significant challenges for healthcare organizations is a staff not equipped to best handle RCM processes. Healthcare organizations need to establish a training process that ensures they are up to date on the latest regulations, policies, and procedures. Staff training should cover insurance verification, medical codes and billing, claims submission and follow-up, and patient collections.

Monitor Key Performance Metrics

Healthcare organizations need to track and analyze their RCM processes regularly. Key performance metrics such as gross collection rate, net collection rate, days in accounts receivable, and denial rate provide insights needed to accurately assess an organization’s financial health. These metrics can help organizations identify areas for improvement and then take corrective action.

Outsource RCM

Outsourcing RCM can provide healthcare organizations with several benefits. Outsourcing RCM can help healthcare organizations reduce costs, improve cash flows, and increase revenue. Outsourcing RCM can also provide access to specialized expertise, technology, and staff. Healthcare organizations should consider outsourcing their RCM if they lack the necessary resources or expertise to manage RCM processes effectively.

Summary: What is revenue cycle management in medical billing?

Prioritizing revenue cycle management is essential in the healthcare industry today. Through efficient revenue cycle management, healthcare organizations can provide better care, make educated operational decisions, and maintain financial stability.

Embracing technology and cultivating a team that has in-depth knowledge of healthcare financial management will provide the foundation for understanding and building an effective RCM program. Ultimately, establishing an effective revenue cycle management is key to unlocking benefits for your healthcare organization in numerous ways, from improved patient care to sound financial performance.

Boost Your RCM Operations and Improve Your Margins with Medical Advantage

Streamlining the revenue cycle may seem like an overwhelming undertaking, but our consulting services will find the best formula for your practice’s financial success. Our proven approach to RCM optimization and training support will help you to improve workflows that minimize accounts receivable and maximize reimbursement – and revenue. Contact us to speak with one of our RCM experts today.